Options Analytics

Built for Edge.

See what market makers see. Real-time volatility surfaces, Greeks visualization, and mispricing detection across 5,500+ tickers.

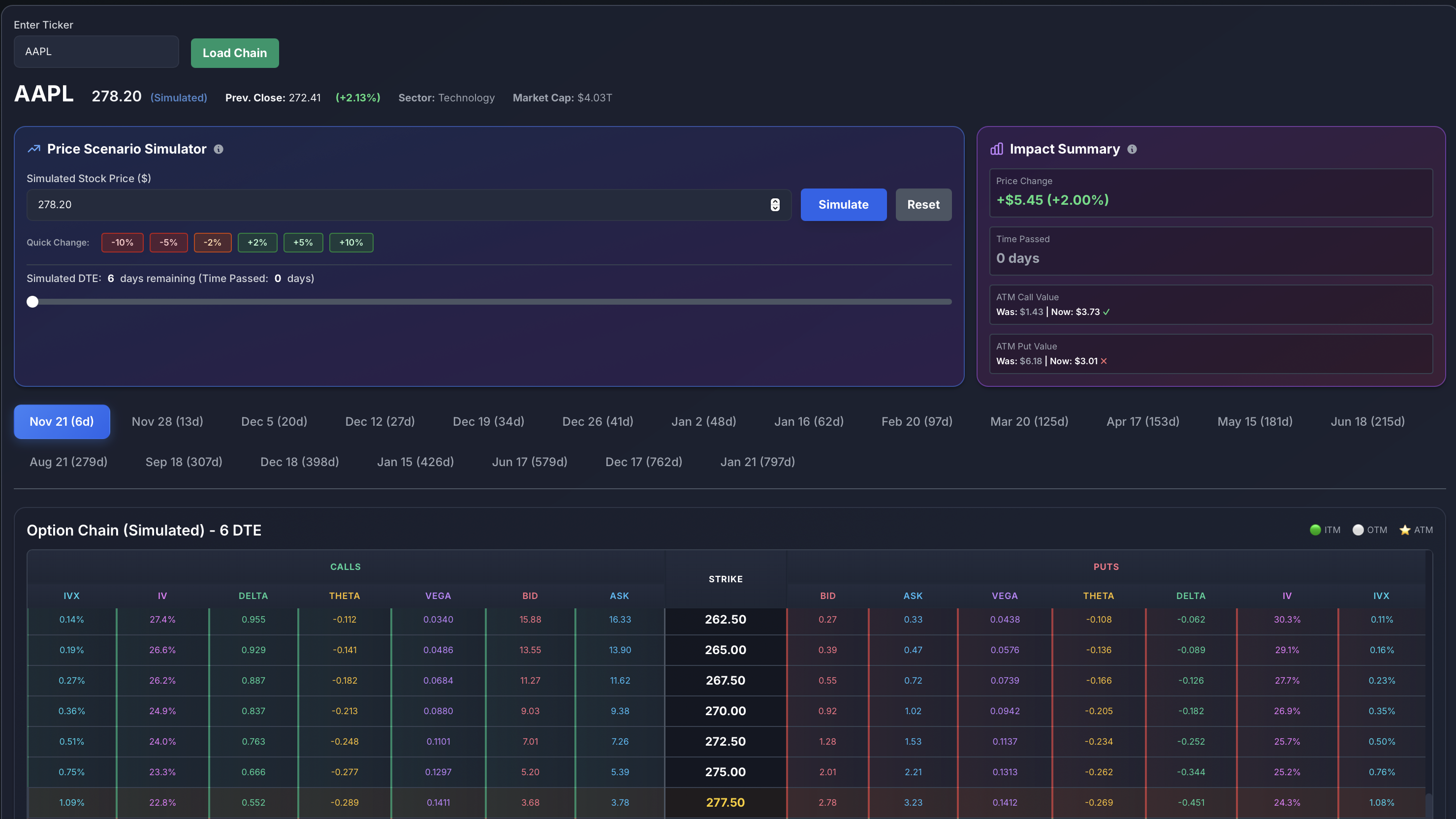

Want to see it first? Try our AAPL demo

Preview the platform with real-time Apple options data. When you're ready for more, start your free trial to unlock all 5,500+ tickers and ETFs.

How It Works

Three simple steps to professional-grade options analysis

Try with AAPL

Start immediately with our free AAPL demo. Explore all features using real-time Apple options data.

Analyze & Learn

Use volatility smiles, term structures, and strategy builders to understand how professionals find edge.

Upgrade & Trade

Ready for more? Sign up for a 7-day free trial to unlock all 5,500+ tickers and advanced features.

See It In Action

Professional-grade tools designed to give you an edge in options trading

360° Options Dashboard

Everything you need in one view. Volatility smile, term structure, live options chain with Greeks, and stock fundamentals.

Try the Dashboard

Greeks Heatmap

Color-coded visualization of Delta, Gamma, Theta, and Vega across all strikes and expirations. Instantly see where the action is.

Explore HeatmapGEX Analysis

See where market makers are positioned. Gamma Exposure reveals support and resistance levels driven by options hedging flows.

View GEX

Volatility Lab

Track IV rank, monitor volatility changes, and compare implied vs realized volatility. Find mispriced options before the crowd.

Open Vol LabTrade Simulator

Build multi-leg strategies with visual payoff diagrams. Test how your position responds to price, time, and volatility changes.

Launch Simulator

Everything You Need to Trade Profitably

19 professional tools across 3 tiers. From essential analytics to institutional-grade insights.

Dashboard

Complete 360° view with volatility smiles, term structures, and live option chains with full Greeks.

Greeks Heatmap

Color-coded Delta, Gamma, Theta, Vega visualization across all strikes and expirations.

Trade Simulator

What-if scenario testing. Adjust price, time, and IV to stress-test positions risk-free.

GEX Analysis

Real-time Gamma Exposure analysis. See where dealers are positioned and predict price magnetism.

Options Flow

Smart money detection. Track unusual options activity and large institutional trades in real-time.

Volatility Lab

IV smile, term structure, and 3D volatility surfaces. Find where volatility is cheap or expensive.

Risk Manager

Portfolio Greeks aggregation, scenario analysis, and hedging recommendations for complex portfolios.

Earnings

Earnings IV patterns and historical move analysis. Optimize your event-driven trading strategies.

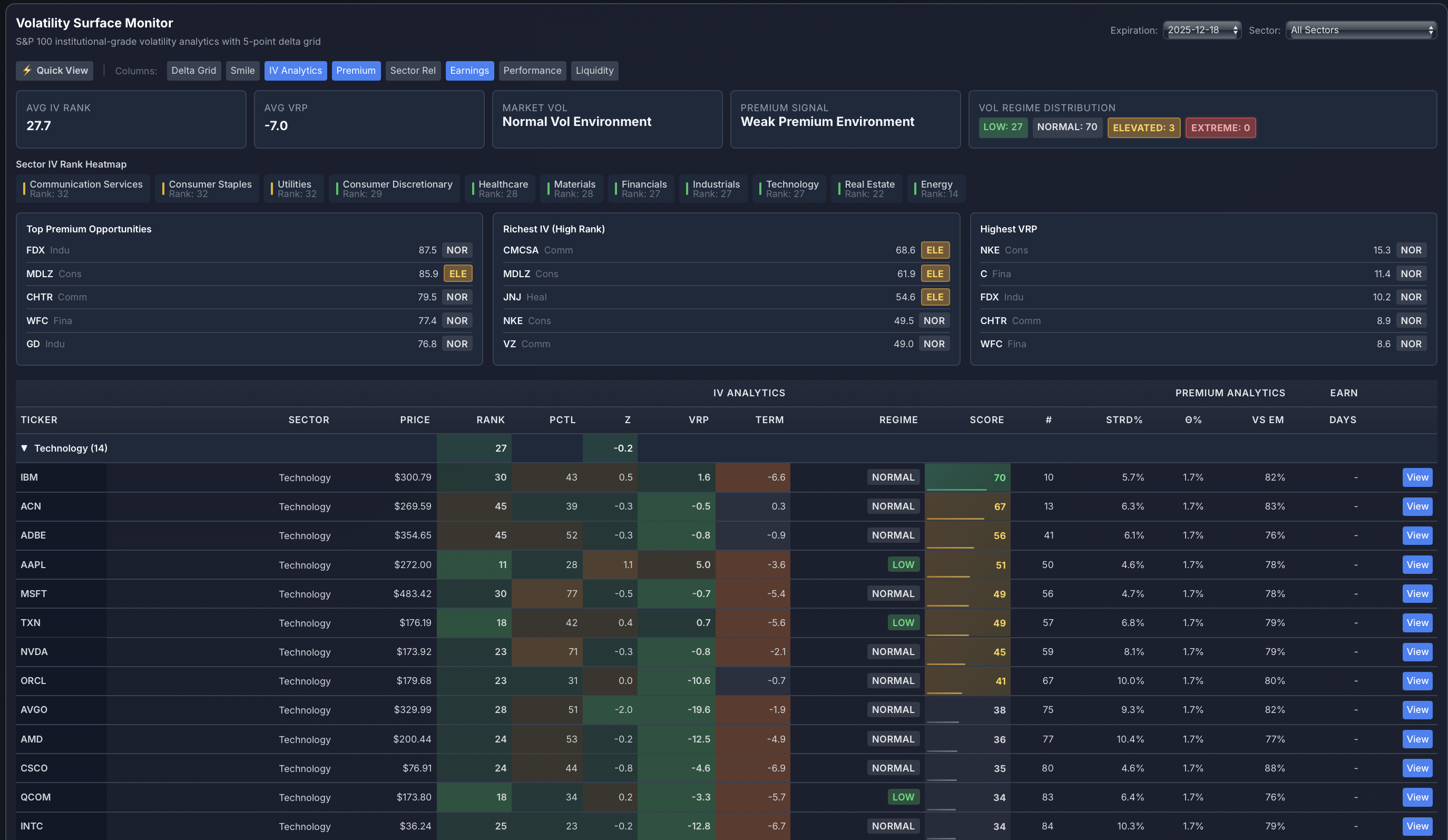

Vol Surface Monitor

S&P 100 institutional-grade volatility analytics. Monitor the broader market's volatility regime.

Built by Traders, For Traders

We built ApexVol because we needed these tools ourselves. Now you can use them too.

Learning Center

Master options trading with our comprehensive guides, calculators, and educational resources

How to Trade Options

Complete beginner's guide covering calls, puts, Greeks, and proven strategies. Learn from real examples.

Options Greeks Guide

Master Delta, Theta, Vega, and Gamma. Understand how Greeks impact your trades with interactive examples.

Free Options Calculator

Calculate profit, loss, breakeven, and Greeks for any strategy. Real-time data for 5,500+ tickers.

All resources are 100% free • No signup required to get started

Options Trading for Beginners: Start Your Journey with ApexVol

New to options trading? Our platform is designed to help beginners learn options trading through hands-on experience with professional-grade tools. Master the fundamentals while using the same analytics that hedge funds rely on.

Why Learn Options Trading?

- ✓ Generate Income: Create monthly cash flow through premium selling strategies like covered calls and cash-secured puts

- ✓ Limited Risk Trading: Define your maximum loss before entering a trade with spreads and defined-risk strategies

- ✓ Portfolio Protection: Hedge stock positions and protect against market downturns with puts and collars

- ✓ Leverage Opportunities: Control 100 shares with less capital while managing risk through proper position sizing

Beginner-Friendly Features

- ✓ Free AAPL Demo: Practice with real-time Apple options data - no signup required to start learning

- ✓ Visual Learning: Interactive charts show how Greeks change in real-time as prices move

- ✓ Risk-Free Simulator: Test strategies with different price scenarios before risking real money

- ✓ Strategy Templates: One-click access to proven strategies like iron condors, spreads, and strangles

Learn by Doing: Your First Options Trade

Start with our free AAPL demo and follow our step-by-step process. Within minutes, you'll understand how to analyze volatility, select strikes, and visualize profit/loss scenarios. No complex theory - just practical, hands-on learning.

Start Learning Options Trading Free →The Complete Option Platform for Every Trading Style

Whether you're a beginner learning the ropes or a seasoned pro managing complex portfolios, ApexVol is the option platform that grows with you. Professional tools without the complexity.

Real-Time Option Platform

Access live options data for 5,500+ tickers and ETFs. Our option platform updates every 15 milliseconds, ensuring you have the freshest Greeks, implied volatility, and bid/ask spreads to make informed decisions.

• Real-time Greeks (Delta, Gamma, Theta, Vega)

• Instant volatility updates

Advanced Analytics Platform

Go beyond basic option chains. Our platform analyzes volatility smiles, term structures, and historical probabilities to help you spot mispriced options and identify high-probability setups.

• Term structure visualization

• IV rank & percentile tracking

Strategy Testing Platform

Build and test any option strategy before risking capital. Our platform's simulator lets you adjust price, time, and volatility to see exactly how your positions will perform under different market conditions.

• What-if scenario testing

• Risk/reward visualization

Why Traders Choose ApexVol as Their Option Platform

Master Proven Option Trading Strategies

Learn and execute profitable option trading strategies with confidence. Our platform includes pre-built templates for the most popular strategies, complete with visual payoff diagrams and risk metrics.

Income Strategies

-

•

Covered Calls: Generate income on stocks you own by selling call options against your position

-

•

Cash-Secured Puts: Get paid to buy stocks at your target price while earning premium

-

•

Iron Condors: Profit from sideways markets by selling both calls and puts

Directional Strategies

-

•

Long Calls/Puts: Simple directional bets with defined risk and unlimited upside potential

-

•

Vertical Spreads: Reduce cost by buying and selling options at different strikes in your direction

-

•

Diagonal Spreads: Combine time decay with directional bias for enhanced returns

Volatility Strategies

-

•

Straddles: Profit from large moves in either direction - perfect before earnings announcements

-

•

Strangles: Lower-cost alternative to straddles with wider breakevens but same unlimited profit potential

-

•

Calendar Spreads: Exploit volatility differences between different expiration dates

Build Any Option Trading Strategy in Seconds

Our platform includes one-click templates for all popular strategies. Simply select your ticker, choose a strategy, and instantly see your payoff diagram, Greeks, breakevens, and maximum profit/loss. Adjust strikes and quantities to optimize for your market outlook.

Real Option Trading Examples: See How It Works

Learn from real-world option trading examples. Each scenario shows you the exact setup, risk/reward profile, and what to look for when entering the trade.

Option Trading Example #1: Covered Call for Income

The Setup

- Position: Own 100 shares of AAPL at $180

- Action: Sell 1 AAPL $185 call expiring in 30 days

- Premium Collected: $3.50 per share ($350 total)

- Maximum Profit: $850 ($500 stock appreciation + $350 premium)

- Breakeven: $176.50 (purchase price - premium)

Why This Works

This option trading example shows how to generate monthly income on stocks you already own. You keep the $350 premium whether the stock goes up, down, or sideways. If AAPL stays below $185, you keep your shares and can sell another call next month. If it goes above $185, your shares are sold at a profit plus you keep the premium.

Pro Tip: Use our volatility analyzer to find the optimal strike price. Selling calls when IV is high (above 50th percentile) maximizes your premium income.

Option Trading Example #2: Bull Put Spread

The Setup

- Outlook: Neutral to bullish on TSLA at $250

- Sell: 1 TSLA $240 put for $4.50 premium

- Buy: 1 TSLA $235 put for $2.80 premium

- Net Credit: $170 ($450 - $280)

- Maximum Risk: $330 ($5 spread - $1.70 credit)

- Max Profit: $170 (keep full credit if TSLA stays above $240)

Strategy Breakdown

This option trading example demonstrates a defined-risk strategy perfect for moderately bullish outlooks. You collect $170 upfront and keep it all if TSLA stays above $240 at expiration. Your maximum loss is limited to $330 if TSLA falls below $235. This is a high-probability trade (typically 70-80% chance of profit) that benefits from both directional movement and time decay.

Best Practices: Look for IV rank above 50. Enter when the underlying is near support levels. Target 30-45 DTE and close at 50% max profit for optimal win rate.

Option Trading Example #3: Long Call Before Earnings

The Setup

- Stock: NVDA trading at $450, earnings in 7 days

- Buy: 1 NVDA $460 call expiring in 14 days

- Premium Paid: $12.50 per share ($1,250 total)

- Breakeven: $472.50 at expiration

- Maximum Risk: $1,250 (premium paid)

- Profit Potential: Unlimited above $472.50

The Trade Logic

This option trading example shows a speculative earnings play. If NVDA beats earnings and jumps to $480, the call could be worth $20 ($2,000 value) for a $750 profit. However, if earnings disappoint and the stock falls, you lose the entire $1,250 premium. This demonstrates the importance of position sizing - never risk more than 1-2% of your account on high-risk directional plays.

Risk Warning: Earnings plays are speculative. Use our implied move calculator to see what price movement is already priced in. Consider selling half before earnings to lock in gains from IV expansion.

Practice These Option Trading Examples Risk-Free

Use our Trade Simulator to test these exact scenarios with different stock prices, time to expiration, and volatility levels. See how each strategy performs before risking real capital.

Complete Transparency

What You Get

- • Real-time options data from major exchanges

- • Professional-grade analytics and Greeks calculations

- • All features unlocked during 7-day trial

- • Email support within 24 hours

- • Regular platform updates and improvements

Important Disclosures

- • Options trading involves significant risk of loss

- • Past performance doesn't guarantee future results

- • Not investment advice - educational tools only

- • Credit card required for free trial (billed after 7 days)

- • Cancel anytime from account settings

Our Promise: If you're not completely satisfied within the first 7 days, cancel with one click for a full refund. No questions asked. We're confident you'll love ApexVol, but we want you to feel secure trying it risk-free.

Start Finding Edge in 60 Seconds

Your first profitable trade opportunity is waiting. Get instant access to institutional-grade options analytics — 100% free for 7 days.

7-day free trial • Cancel anytime • Full platform access